Wave Goodbye to Recession Fears

Top Stocks to Own as Global Markets Surge!

Before we dive into this week’s insights on value investing, I wanted to share something that has truly enhanced my own investment strategy. Recently, I’ve been reading the Bullseye Trades newsletter, and it’s been a game-changer for me. Whether it’s spotting emerging trends or providing deep dives into market movements, Bullseye Trades delivers sharp, actionable content that complements my focus on long-term value investing. I’ve found that combining the timely insights from Bullseye Trades with my value-oriented approach has opened up new avenues for profitable opportunities.

Trade Smarter with these Free, Daily Stock Alerts

It’s never too late to learn how to master the stock market.

You’ll receive daily trade alerts sent directly to your phone and email detailing the hottest stock picks.

The best part? There’s no cost to join!

Expert insights will be at your fingertips instantly.

Introduction

Welcome to this week’s edition of your essential investment guide! As global markets rally and recession fears start to dissipate, it’s time to look ahead with optimism and strategic foresight. This week, we’re focusing on how you can capitalize on the burgeoning market trends and identify stocks that are not just surviving but thriving. Dive into our expert analysis and uncover the top stocks that promise robust returns in a revitalizing economy.

In today’s AIhustleswithryan

Global Market Overview

Insights into the current market surge and what it means for investors.Top Stocks to Watch

Detailed analysis of the best-performing stocks in this optimistic economic climate.Investment Strategies

Tailored advice on how to adjust your portfolio to maximize gains.Risk Management Tips

Essential tips to safeguard your investments against any potential volatility.Success Stories

Real-life examples of investors who have successfully capitalized on market upswings.

Estimated Reading Time: 7 minutes

A) Global Market Overview

A New Dawn for Investors

Economic Resilience Shines Through

After months of uncertainty, global markets are showing remarkable resilience, casting aside the gloom of recession fears. This turnaround is powered by positive economic indicators across major economies, including rebounding consumer spending and stabilizing employment rates. As an investor, this signals a golden opportunity to re-evaluate your investment strategies and prepare for potential growth.

As we navigate through these dynamic times, we’d love to hear your thoughts on where you think the market is headed.

- Bullish 🐂: I believe the markets will continue to rally, and now is a great time to invest.

- Cautiously Optimistic 🤔: I see potential for growth, but I’m keeping an eye on possible risks.

- Neutral 😐: I’m uncertain about the market direction and prefer to wait and see.

- Bearish 🐻: I expect the markets to face more challenges, and I’m considering more defensive strategies.

- Unsure 🤷: I’m not sure what to expect and would appreciate more insights and guidance.

B) Top Stocks to Watch

Your Gateway to Growth

1. Tech Titans Rebound

Technology stocks, once the harbingers of volatility, are now leading the charge. Companies like Apple and Microsoft have shown impressive resilience, bouncing back stronger as digital transformation continues to drive their growth.

Apple Inc. (AAPL)

Resilience Through Innovation:

Apple has long been a leader in consumer technology, but what sets it apart is its relentless innovation and ability to adapt to changing market conditions. Despite the challenges posed by global supply chain disruptions and inflationary pressures, Apple has continued to deliver strong financial performance, driven by its diverse product ecosystem.

Key Growth Drivers

iPhone Dominance

The iPhone remains Apple’s flagship product, contributing significantly to its revenue. The launch of new models with advanced features has kept demand robust, even in mature markets.Services Segment Boom

Apple’s services segment, which includes the App Store, Apple Music, and iCloud, has become a major revenue generator. This segment offers higher margins and recurring revenue, providing stability and growth potential.Wearables and Accessories

Products like the Apple Watch and AirPods have created new revenue streams, further diversifying Apple’s portfolio.Expansion in Emerging Markets

Apple’s strategic focus on expanding its presence in emerging markets like India and Southeast Asia is paying off, with growing adoption of its products and services.

Market Performance

Stock Price Recovery

After experiencing volatility during the peak of global economic uncertainty, Apple’s stock has rebounded, reflecting investor confidence in its long-term prospects. The company’s consistent earnings growth and strong balance sheet have been key factors in this recovery.Dividend Stability

Apple continues to reward its shareholders with regular dividends, supported by its massive cash reserves. This makes Apple an attractive option for both growth and income-focused investors.

As digital transformation continues to reshape industries, Apple is well-positioned to capitalize on these trends. With its expanding ecosystem and strong brand loyalty, Apple is expected to maintain its growth trajectory, making it a cornerstone in any tech-focused investment portfolio.

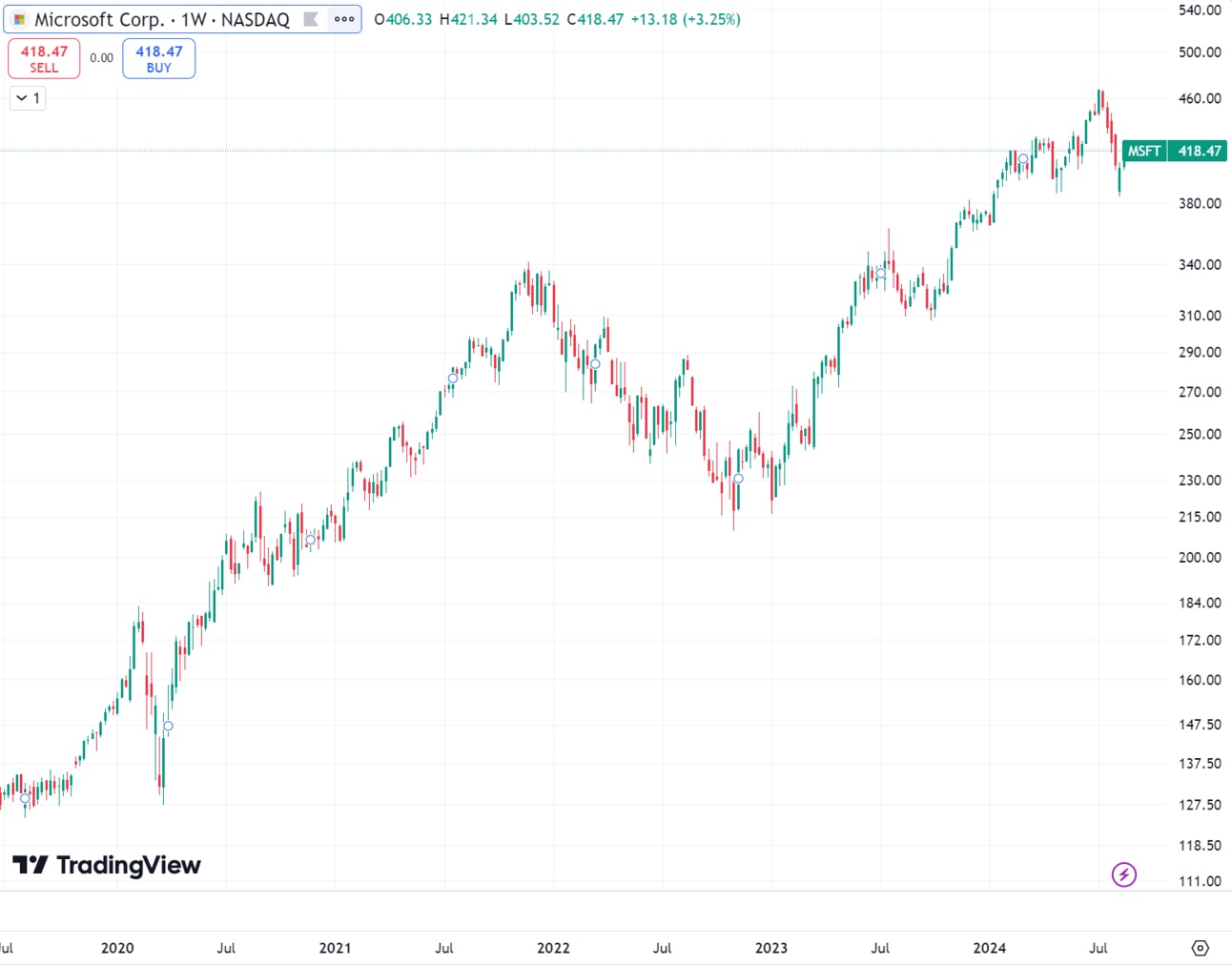

Microsoft Corporation (MSFT):

Driving the Future of Technology

Microsoft, under the leadership of CEO Satya Nadella, has transformed from a traditional software company into a cloud computing powerhouse. The company’s strategic pivot towards cloud services, AI, and enterprise solutions has paid off, allowing it to capture significant market share and drive sustained growth.

Key Growth Drivers:

Azure Cloud Dominance

Microsoft’s Azure cloud platform has become a critical growth engine, as businesses worldwide accelerate their digital transformation. Azure’s revenue growth continues to outpace the broader market, driven by strong demand for cloud computing, AI, and data analytics services.Office 365 and Productivity Tools

Microsoft’s Office 365 suite remains a staple for businesses and educational institutions. The shift to remote and hybrid work has increased demand for productivity tools, solidifying Microsoft’s dominance in this space.Gaming and Entertainment

The success of Xbox and the expansion of Microsoft’s gaming ecosystem, including the acquisition of game studios and the growth of Xbox Game Pass, have opened up new revenue streams. This diversification adds resilience to Microsoft’s business model.LinkedIn and Enterprise Solutions

LinkedIn’s integration with Microsoft’s cloud services and its growing advertising revenue contribute to the company’s bottom line. Additionally, Microsoft’s enterprise solutions, such as Dynamics 365, are gaining traction among large organizations.

Market Performance

Stock Price Growth

Microsoft’s stock has been on a steady upward trajectory, reflecting its strong financial performance and growth potential. The company’s ability to deliver consistent revenue and earnings growth, even in challenging economic conditions, has made it a favorite among investors.Dividend Growth

Microsoft has a long history of returning capital to shareholders through dividends. The company’s robust cash flow supports regular dividend increases, making it an attractive choice for income-oriented investors.

Microsoft’s future looks bright as it continues to lead in cloud computing, AI, and enterprise solutions. The company’s strong position in high-growth markets, combined with its commitment to innovation, suggests that it will remain a dominant player in the technology sector for years to come.

2. Green Energy Gains Momentum

As the world shifts towards sustainability, green energy companies such as NextEra Energy and Tesla are seeing a surge in interest. Their commitment to innovation and sustainable solutions makes them attractive prospects for any future-focused portfolio.

NextEra Energy (NEE): Powering the Future with Renewable Energy

Company Overview

NextEra Energy is one of the world’s largest producers of renewable energy from the wind and sun. Headquartered in Florida, the company is a leader in the transition to clean energy, with a portfolio that includes both renewable energy generation and traditional energy services. Through its subsidiaries, including Florida Power & Light and NextEra Energy Resources, the company serves millions of customers and operates a vast network of renewable energy projects across the United States.

Why NextEra Energy is Thriving:

Commitment to Renewable Energy: NextEra has been at the forefront of the renewable energy revolution, with over 45 gigawatts of wind, solar, and battery storage projects either in operation or development. This positions the company well to capitalize on the growing demand for clean energy.

Strong Financial Performance: NextEra’s financials have been robust, with consistent earnings growth driven by its investments in renewable energy. The company has maintained a strong balance sheet, allowing it to continue expanding its renewable energy projects.

Favorable Regulatory Environment: With increasing governmental support for renewable energy through subsidies, tax incentives, and favorable regulations, NextEra is well-positioned to benefit from these tailwinds.

Strategic Growth Plans: The company’s long-term growth strategy includes significant investments in battery storage technology, which is crucial for addressing the intermittency of renewable energy sources like wind and solar.

Investment Outlook

NextEra Energy represents a solid investment opportunity for those looking to gain exposure to the green energy sector. Its focus on renewable energy, coupled with strong financial performance and strategic growth initiatives, makes it a compelling choice for investors seeking long-term growth in a rapidly expanding market.

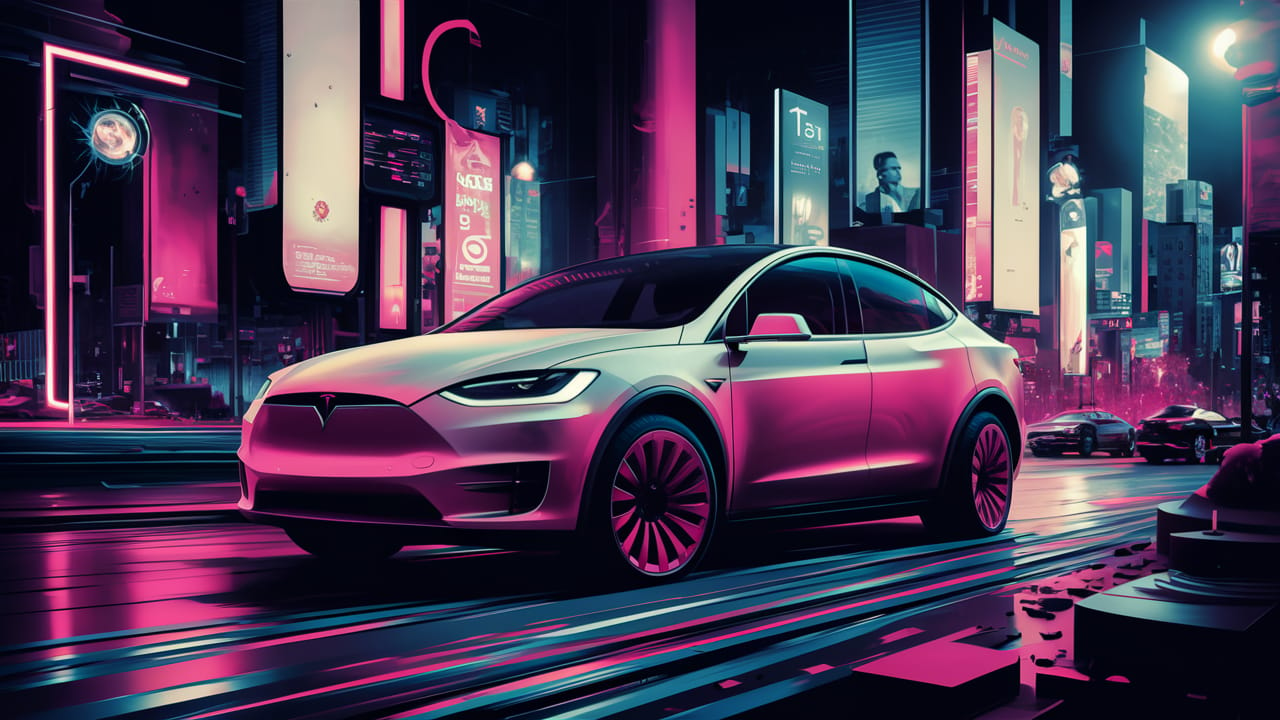

Tesla (TSLA): Driving the Electric Revolution

Company Overview

Tesla, Inc., founded by Elon Musk, is synonymous with innovation in the electric vehicle (EV) market. What began as an ambitious venture to create sustainable transportation has evolved into a global powerhouse in the EV and clean energy sectors. Tesla’s product lineup extends beyond vehicles to include energy storage solutions and solar products, making it a key player in the broader green energy landscape.

Why Tesla is a Green Energy Leader:

Dominance in Electric Vehicles

Tesla is the world’s leading EV manufacturer, with a market share that continues to grow as more consumers and governments prioritize the shift to electric transportation. Tesla’s Model 3 and Model Y are particularly popular, driving the company’s sales and revenue growth.Cutting-Edge Battery Technology

Tesla’s advances in battery technology are critical to its success. The company’s proprietary batteries offer superior range, efficiency, and cost-effectiveness, giving it a significant edge over competitors. Tesla’s Gigafactories, dedicated to producing batteries at scale, further strengthen its leadership in this area.Vertical Integration and Innovation

Tesla’s unique approach to vertical integration, controlling everything from manufacturing to software development, allows it to innovate rapidly and maintain high-profit margins. This approach also gives Tesla greater control over its supply chain, which has proven advantageous during global supply chain disruptions.Expansion into Energy Solutions

Beyond cars, Tesla is making strides in energy storage and solar power. Products like the Tesla Powerwall and Solar Roof are gaining traction, positioning Tesla as a major player in the clean energy industry beyond automotive.

Investment Outlook

Tesla remains one of the most talked-about stocks in the market, and for good reason. Its leadership in EVs, coupled with its expansion into energy storage and solar products, presents a unique investment opportunity. While the stock has experienced volatility, its long-term growth prospects, driven by continued innovation and increasing global demand for sustainable solutions, make it a valuable addition to a future-focused portfolio.

3. Healthcare Heroes

The healthcare sector continues to be a bastion of stability and growth. Stocks like Pfizer and Johnson & Johnson not only offer a safe haven during market fluctuations but also promise long-term growth driven by ongoing demand for healthcare solutions.

Pfizer Inc. (PFE)

Company Overview

Pfizer, one of the world’s largest pharmaceutical companies, has long been a leader in developing and marketing innovative healthcare solutions. The company’s broad product portfolio includes vaccines, oncology therapies, and treatments for rare diseases. Pfizer’s strategic focus on research and development (R&D), coupled with its ability to bring new drugs to market, positions it as a robust player in the healthcare sector.

Key Growth Drivers

Vaccine Leadership

Pfizer’s role in developing the COVID-19 vaccine, in partnership with BioNTech, has significantly boosted its revenues and global profile. This vaccine continues to be a major revenue stream, and Pfizer is also expanding its vaccine pipeline to include treatments for other infectious diseases.Strong R&D Pipeline

Pfizer has a robust R&D pipeline with several promising drugs in late-stage clinical trials. This pipeline spans multiple therapeutic areas, including oncology, immunology, and cardiovascular health, which could drive future growth.Global Reach

Pfizer’s extensive global distribution network allows it to reach diverse markets, providing a steady revenue stream even in challenging economic environments.

Investment Outlook

Pfizer’s strong financial performance, bolstered by its vaccine sales, has solidified its position as a top performer in the healthcare sector. The company’s commitment to innovation and its diversified product portfolio suggest that Pfizer will continue to deliver value to shareholders. For investors seeking a blend of stability and growth, Pfizer offers a compelling opportunity.

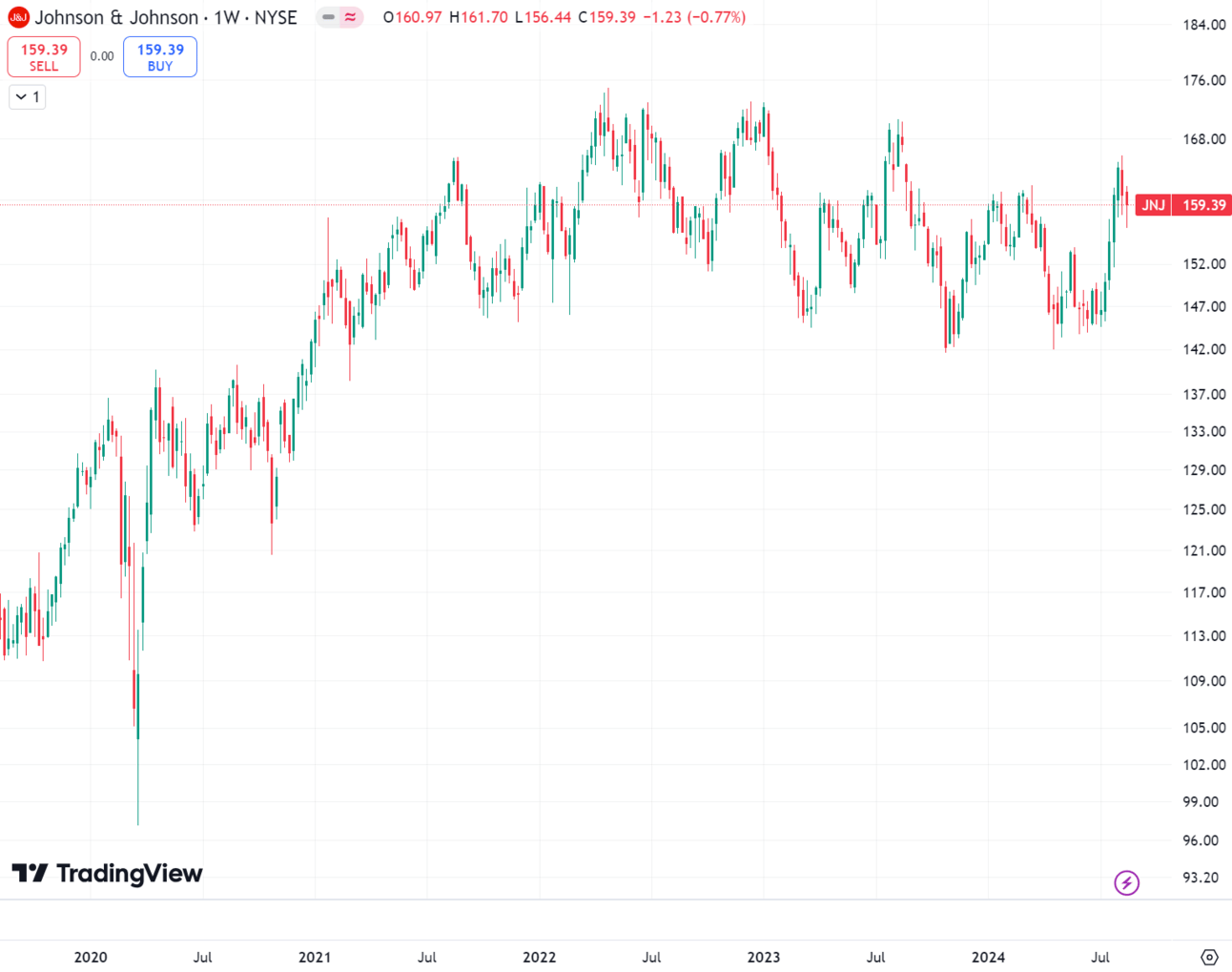

Johnson & Johnson (JNJ)

Company Overview

Johnson & Johnson is a diversified healthcare conglomerate with operations in pharmaceuticals, medical devices, and consumer health products. The company is known for its strong brand portfolio, including household names like Tylenol, Band-Aid, and Neutrogena. Johnson & Johnson’s size and diversification make it a resilient player in the healthcare industry.

Key Growth Drivers

Pharmaceutical Division

Johnson & Johnson’s pharmaceutical division is a key growth engine, with a focus on high-demand therapeutic areas such as oncology, immunology, and neuroscience. The company has several blockbuster drugs that continue to drive revenue growth.Medical Devices

The medical devices segment is another area of strength, particularly as elective surgeries and medical procedures rebound following the pandemic. Innovations in surgical technology and orthopedics are expected to contribute to long-term growth.Consumer Health

Johnson & Johnson’s consumer health products provide a steady stream of revenue, offering a cushion during economic downturns. The company’s strong brand equity in this segment ensures continued consumer demand.

Investment Outlook

Johnson & Johnson’s diversified business model and its focus on high-growth areas within healthcare make it a formidable investment choice. The company’s commitment to innovation and its strong balance sheet provide a foundation for continued success. With a reliable dividend and a history of steady earnings growth, Johnson & Johnson is a cornerstone stock for any value-oriented portfolio.

Why Healthcare Stocks Remain Resilient

Defensive Characteristics

Healthcare is a necessity, not a luxury, which means demand for healthcare services and products remains stable even during economic downturns. This defensive characteristic makes healthcare stocks less sensitive to market fluctuations compared to other sectors.

Innovation-Driven Growth

The healthcare sector is continually evolving, with companies investing heavily in research and development to bring new treatments and technologies to market. This focus on innovation ensures that leading healthcare companies remain at the forefront of addressing global health challenges, driving both revenue and long-term shareholder value.

Demographic Trends

Aging populations in developed markets and increasing access to healthcare in emerging markets provide a solid growth foundation for the sector. Companies like Pfizer and Johnson & Johnson are well-positioned to benefit from these demographic trends, as they expand their product offerings to meet the growing demand.

C) Investment Strategies

Optimizing Your Portfolio

Embrace Diversification

Diversifying your portfolio across these resilient sectors can reduce risk and increase potential returns. Consider balancing your holdings between tech, green energy, and healthcare to capitalize on different growth drivers.

Stay Informed

Keeping abreast of market trends and economic indicators can help you adjust your investment strategy dynamically. Use tools like Bloomberg and Reuters for real-time data and analysis.

D) Risk Management Tips

Secure Your Investments

Set Stop-Loss Orders

To protect against sudden market downturns, consider setting stop-loss orders. These can help lock in profits and prevent significant losses, allowing you to invest more confidently.

Regular Portfolio Reviews

Conduct regular reviews of your portfolio to ensure it aligns with your investment goals and risk tolerance. Adjust your holdings as needed to stay on track for your financial objectives.

E) Success Stories

Learning from the Best

The Turnaround Trader

Meet Emily, a part-time investor who used strategic investments in tech stocks to double her portfolio value during the market recovery. Her success story is a testament to the power of staying informed and being ready to act when opportunities arise.

Conclusion:

As the global markets surge, the savvy investor looks not just to participate but to excel. By focusing on high-growth sectors and employing strategic investment practices, you can turn current trends into substantial gains. Remember, the best time to plant a tree was 20 years ago. The second best time is now. Let’s make the most of this economic spring!

Unlock Your Investment Potential with Super Investor Club!

I've always believed in investing in myself, and joining the Super Investor Club has been the best decision I've ever made. Through their expert guidance, I've mastered value investing, opened my brokerage account, and started trading confidently. The results speak for themselves—I've consistently achieved over 20% ROI for the past 5 months!

If you're serious about growing your wealth and want to learn from the best, this is your chance. Don't miss out on the opportunity to transform your financial future.

👉 Join the Super Investor Club today and start your journey toward consistent profits!

Thank you for trusting us with your investment journey. Your success is our top priority. If you have any topics or questions you’d like us to cover, please reply to this email. We’re here to help!

LEGAL DISCLAIMER

This newsletter is for informational purposes only and does not constitute financial advice. Investments are subject to market risks, including the loss of principal. Always conduct your research or consult with a financial advisor before making any investment decisions.