👉🏻🚀 Profit Big: Leverage From Mr. Market's Miscalculation!

Introduction

Good morning, value investors! 🚗 As I navigated the morning school run today, I reflected on how traffic patterns can be unpredictable, much like the stock market. Recently, I’ve been diving into the insights from the Bullseye newsletter and Howard Marks’ memo, "Mr. Market Miscalculates," and I wanted to share how understanding market misjudgments can help you on your journey to financial freedom through value investing. Let’s unpack this together!

This week in AIhustleswithryan

Market Misjudgments

Markets often overreact to short-term events, creating opportunities for astute investors to buy quality assets at a discount.Importance of Patience

Success in value investing requires patience and a long-term perspective, allowing time for the market to correct its miscalculations.Contrarian Thinking

To capitalize on market errors, investors must be willing to go against the crowd, buying when others are selling.

Estimated Reading Time: 7 minutes

As we dive into this week's insights on value investing, I’d like to share a personal reflection on how my journey began. 🌱 My first steps into the world of investing were filled with curiosity and a dash of uncertainty—much like embarking on any new adventure. A pivotal moment came when I started reading the Bullseye newsletter 📰, which helped me understand "Mr. Market" and his unpredictable nature. Their clear, thoughtful analysis taught me the importance of staying grounded in fundamentals, even when market sentiment seemed irrational.

With this newfound understanding, I saw value investing as more than just a strategy—it became a disciplined path towards achieving financial freedom. 💼 Let's explore how you can apply these principles to make smart, informed decisions that align with your long-term goals. 🚀

Our Partner

Trade Smarter with these Free, Daily Stock Alerts

It’s never too late to learn how to master the stock market.

You’ll receive daily trade alerts sent directly to your phone and email detailing the hottest stock picks.

The best part? There’s no cost to join!

Expert insights will be at your fingertips instantly.

Understanding Market Misjudgments

A Value Investor’s Opportunity 🎯

Howard Marks points out that markets often misprice assets due to emotional overreactions, creating golden opportunities for value investors. 💡 For instance, when fear grips the market, even strong stocks may be sold off indiscriminately. This is when savvy investors can scoop up high-quality assets at a discount!

Embracing Patience

The Key to Long-Term Success 🕰️

Patience is more than a virtue in value investing—it’s a strategy! Marks emphasizes that while the market may make mistakes in the short term, it generally corrects over time. 📈 By staying the course and focusing on intrinsic value, you can reap substantial rewards as the market realigns with reality.

Contrarian Thinking

Going Against the Grain 🚀

To truly capitalize on market errors, you must be prepared to think differently. 🤔 Marks advocates for a contrarian mindset—buying when others are fearful and selling when they’re overly optimistic. This requires both courage and conviction in your analysis, but it’s a proven path to uncovering hidden gems.

Actionable Steps for Value Investors 📝

🔍 Identify Mispricings: Keep an eye out for assets undervalued due to market overreactions.

🛑 Hold for the Long Term: Maintain focus on the intrinsic value of your investments and be patient.

🧭 Think Differently: Embrace a contrarian approach, stepping in when the market is stepping out.

Now that we've explored some key principles of value investing and shared insights from my own journey, I'm curious to hear from you! Everyone approaches investing differently, and understanding where you stand can help us tailor future content to better suit your needs.

Let's make this a two-way conversation! Take a moment to share your investing style and preferences in the quick poll below. Your feedback will help us provide more personalized and relevant content.

How Do You Approach Value Investing?

- 📊 I'm a Data-Driven Investor: I rely heavily on market data and analytics to guide my investment decisions.

- 🧠 I Trust My Instincts: I make investment decisions based on gut feeling and market sentiment.

- 📚 I Follow the Experts: I prefer to learn from the insights of experienced investors and newsletters like Bullseye.

- 🕰️ I'm a Long-Term Planner: I focus on holding stocks for the long haul, regardless of short-term market fluctuations.

- ❓ Still Learning: I'm new to value investing and exploring different strategies to find what works best for me.

Conclusion:

Market miscalculations are not just inevitable—they’re opportunities waiting to be seized! 🌱 By understanding these dynamics and applying a disciplined value investing strategy, you can take confident strides towards financial freedom. Remember, patience, a contrarian mindset, and a focus on long-term value are your best tools in this journey.

Are you ready to navigate the waves of market miscalculations? 🌊 Start leveraging these insights today to identify undervalued opportunities and strengthen your portfolio!

Before we wrap up today's enlightening edition, I want to share a personal milestone that could be a game-changer for many of you. When I first started investing, I was a complete novice, unsure of where to begin or what strategies to trust. That's when I discovered the Super Investor Club, and it transformed my journey. Under the guidance of experts like Sean Seah and with the support of a dynamic community, I gained the confidence to make informed trades and achieved an impressive 30% ROI in just six months!

My portfolio since I started investing in Feb 2024

Now, I'm excited to offer you the same opportunity. This month, the Super Investor Club is offering a special 2-week free trial, but hurry—this offer is only valid for the last week until the end of the month! Don’t miss out on this chance to start your own success story. Click here to join today and embark on your journey towards financial freedom with the guidance and support you need to thrive. 🌟

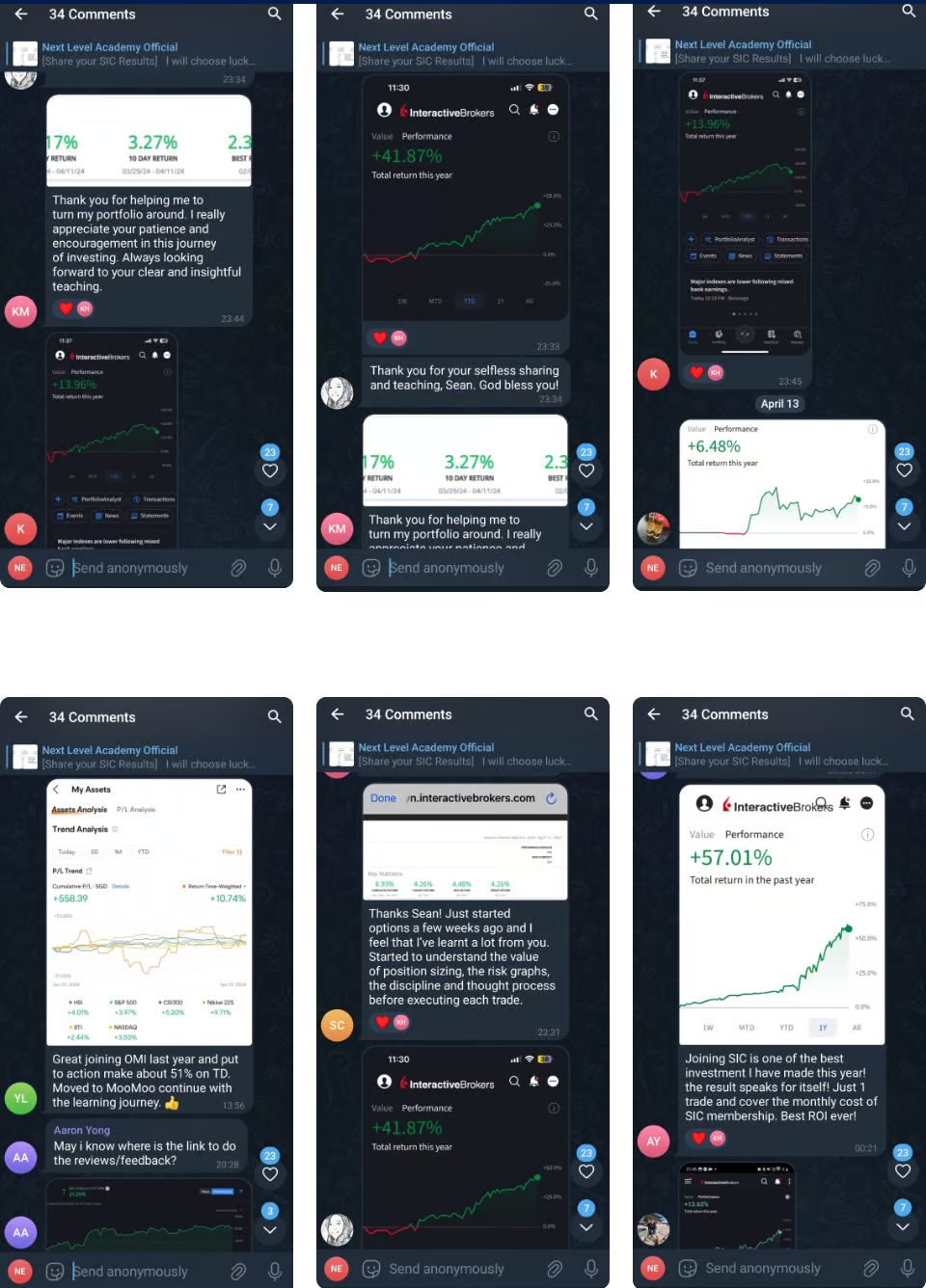

Hear what other members have to say!

Thanks for joining me on this adventure. Your insights and engagement keep our community thriving. Got a topic you’re curious about? Hit reply—I’m here to help! 💬

LEGAL DISCLAIMER

This newsletter is for informational purposes only and does not constitute financial advice. Investments are subject to market risks, including the loss of principal. Always conduct your research or consult with a financial advisor before making any investment decisions.